Unknown Facts About Estate Planning Attorney

Unknown Facts About Estate Planning Attorney

Blog Article

The Best Guide To Estate Planning Attorney

Table of ContentsTop Guidelines Of Estate Planning AttorneyEstate Planning Attorney - The FactsNot known Facts About Estate Planning AttorneyEstate Planning Attorney Things To Know Before You Get This

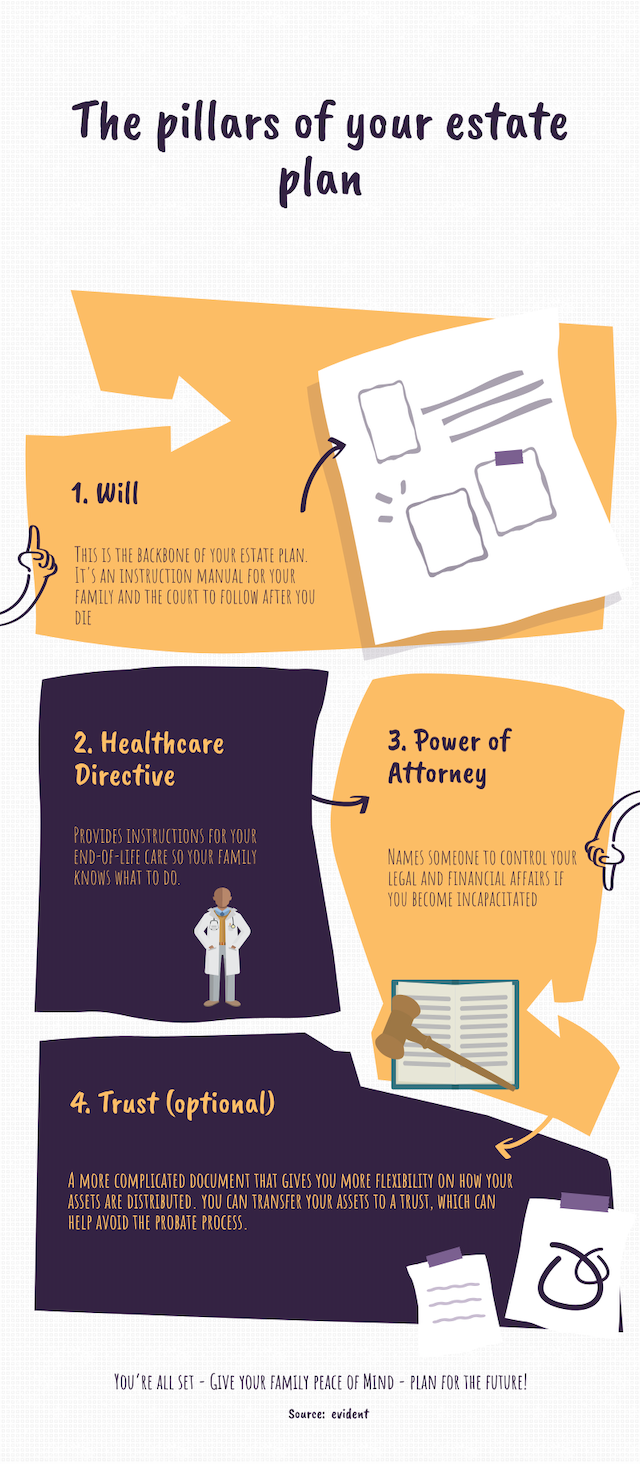

Estate preparation is an action plan you can utilize to establish what happens to your assets and responsibilities while you're alive and after you die. A will, on the various other hand, is a lawful document that describes exactly how properties are dispersed, who cares for kids and pet dogs, and any other desires after you die.

Claims that are turned down by the administrator can be taken to court where a probate judge will have the last say as to whether or not the claim is valid.

Some Known Questions About Estate Planning Attorney.

After the inventory of the estate has been taken, the value of possessions determined, and tax obligations and financial obligation repaid, the administrator will certainly after that look for permission from the court to disperse whatever is left of the estate to the recipients. Any type of estate tax obligations that are pending will certainly come due within 9 months of the day of death.

Each individual locations their possessions in the trust fund and names someone apart from their spouse as the recipient. Nonetheless, A-B trusts have become less prominent as the inheritance tax exemption works well for many estates. Grandparents may transfer possessions to an entity, such as a 529 plan, to sustain grandchildrens' education and learning.

Excitement About Estate Planning Attorney

Estate planners can function with the contributor in order to decrease gross income as a result of those contributions or create methods that optimize the impact of those donations. This is an additional technique that can be utilized to restrict death tax obligations. It includes an individual securing in the present value, and therefore tax responsibility, of their residential property, while associating the this website worth of future growth of that resources to one more person. This method entails cold the worth of a possession at its value on the date of transfer. As necessary, the quantity of prospective resources gain at death is additionally frozen, permitting the estate planner to approximate their potential tax obligation liability upon fatality and far better plan see page for the settlement of income tax obligations.

If sufficient insurance coverage proceeds are offered and the plans are properly structured, any type of revenue tax on the considered personalities of assets complying with the fatality of an individual can be paid without turning to the sale of properties. Profits from life insurance policy that are obtained by the recipients upon the death of the insured are normally revenue tax-free.

There are certain files you'll need as part of the estate preparation procedure. Some of the most typical ones consist of wills, powers of lawyer (POAs), guardianship classifications, and living wills.

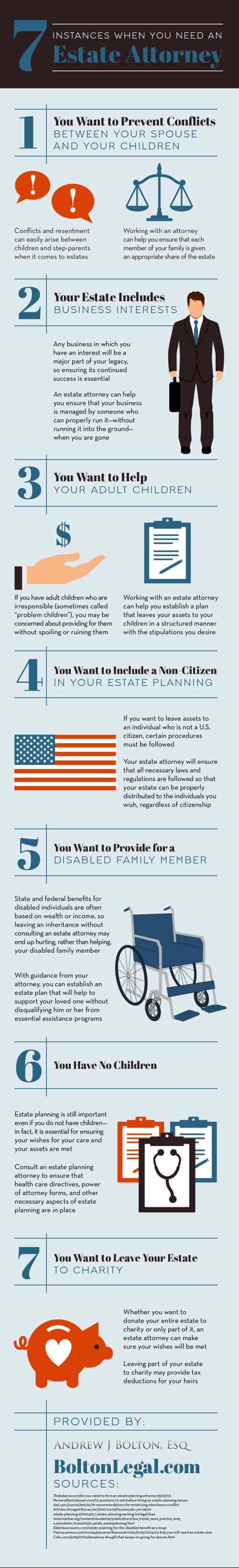

There is a myth that estate planning is just for high-net-worth people. Estate planning makes it easier for individuals to determine their wishes prior to and after they pass away.

10 Simple Techniques For Estate Planning Attorney

You should begin preparing for your estate as soon as you have any type of measurable property base. It's a continuous procedure: as life advances, your estate plan must shift to match your conditions, according to your new objectives. And maintain it. Refraining from doing your estate planning can create undue economic concerns to enjoyed ones.

Estate planning is commonly taken a tool for the well-off. That isn't the case. It can be a helpful means for you to deal with your possessions and responsibilities before and after you die. Estate preparation is also a terrific means for you to lay out plans for the care of your small children and animals and to detail your yearn for your funeral and preferred charities.

Qualified candidates who pass the test will be officially licensed in August. If you're eligible why not find out more to sit for the test from a previous application, you may file the brief application.

Report this page